Boost Your Insurance Agency's Performance with Custom CRM for Insurance Agencies

Discover the ease of creating your AI-enhanced custom CRM for insurance agencies with Flatlogic

Why Insurance Agencies Need CRM Systems

A CRM (Customer Relationship Management) system acts as a digital assistant in an insurance agency, efficiently organizing details about your clients and potential leads. For instance, if you have a client with specific insurance needs or preferences, the CRM tracks their policy history, preferences, and feedback. It facilitates consistent communication with them.

This tool is crucial for delivering tailored insurance solutions and ensuring that no important details are missed about the clients who are critical to your agency’s success.

6 Key Benefits of Using CRM for Insurance Agencies

Benefit #1: Strengthen Client Relationships

With your CRM for insurance agencies, you can create comprehensive profiles for each client, including their policy history and preferences. This allows for personalized interactions, building stronger, more lasting client relationships.

Benefit #2: Enhance Time Management

Your CRM for insurance agencies automates various tasks, such as scheduling appointments and sending policy updates, reducing the administrative burden and freeing up more time for client engagement.

Benefit #3: Centralize Client Information

CRM for insurance agencies consolidates all client information in one location, from contact details to policy files. This centralization provides quick and efficient access to essential data, facilitating better policy management.

Benefit #4: Identify New Business Opportunities

Your CRM for insurance agencies can analyze client data and market trends to identify potential new business opportunities, enabling you to effectively tailor your services to meet market demands.

Benefit #5: Access to Actionable Insights

Your CRM for insurance agencies does more than just store data; it analyzes it to provide actionable insights. Track patterns such as successful policy offerings or client feedback to refine your insurance strategies.

Benefit #6: Streamline Information Management

Managing an insurance agency involves handling a multitude of details and documents. CRM for insurance agencies helps in organizing these elements, ensuring accurate and efficient management of your client portfolios.

Top 4 Essential CRM Features for Insurance Agencies

Understanding Your Clients

Think of Client Profile Management in your CRM for insurance agencies as creating a detailed profile for each client. Just as you recall specific details about business contacts, this feature enables you to track each client's policy history and preferences. Whether they prefer comprehensive coverage or minimum liability, you’ll have that information easily accessible.

Your Policy Management Organizer

Task and Calendar Management in your CRM for insurance agencies functions as your personal coordinator. It alerts you about upcoming policy renewals, client meetings, or claim deadlines, similar to how you set personal reminders. This keeps you organized and ensures no critical insurance tasks are overlooked.

Detailed Record of Client Communications

Communication Tracking in your CRM for insurance agencies is akin to maintaining a log of all significant client interactions. Whether it’s discussing policy adjustments or receiving client feedback, your CRM documents it, preparing you for informed future interactions.

Strategizing for Insurance Success

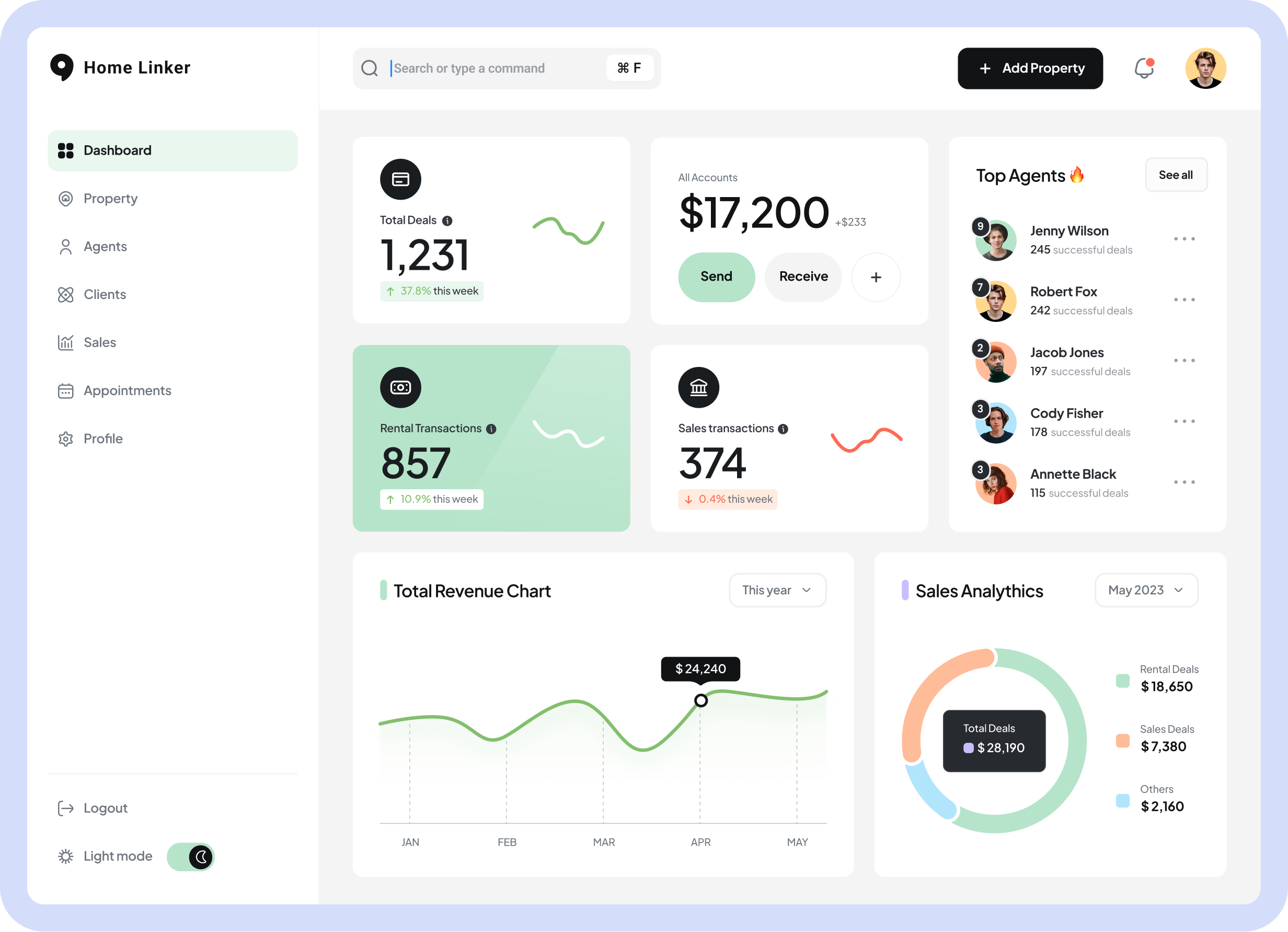

Analytics and Reporting in your CRM for insurance agencies act as your strategic guide. By analyzing client data and performance, identifying trends such as effective coverage options or areas for improvement, you can tailor your insurance efforts to better meet client needs and optimize operational results.

case study

Flatlogic for Custom CRM in Insurance Agencies: The Ultimate Insurance Solution

Flatlogic makes it easy to build a CRM. You get to control everything and can change it as your business grows.

Develop a fully operational Insurance Agency CRM MVP in just a few hours with Flatlogic, significantly surpassing typical industry development times. Customize it to fit your specific insurance agency needs, with complete access to the source code for in-depth personalization.

Achieve a major reduction in development time, saving over 300 hours compared to traditional CRM implementations. This accelerated process is not only faster but also more cost-effective, potentially reducing your development costs by up to 50%.

Flatlogic's CRM for Insurance Agencies is versatile, perfect for different insurance strategies and client types, from individual policyholders to large corporations. Tailor its features to suit diverse insurance tasks, boosting its effectiveness across your agency.

Gain from AI-driven analytics and insights, skilled in analyzing detailed client and policy data for more informed decision-making. Enjoy continuous support and regular updates from Flatlogic, ensuring your CRM for insurance agencies remains up-to-date with the latest insurance trends and technologies.

Contact UsBenefits of Choosing Flatlogic's Business Software AI Generator for Your Insurance Agency CRM

- Customized, Scalable CRM Solution

You will receive a robust and scalable CRM solution, expertly designed to meet the specific needs of your insurance agency. - Flexible and Adaptive CRM

You will acquire a CRM system that not only adjusts but also evolves with your insurance strategies, ensuring its effectiveness and long-term relevance. -

Exceptional Customization Options

You will have the opportunity to tailor the code to precisely fit your insurance agency's unique needs, offering unmatched personalization capabilities. - Complete System Ownership

You will gain full access to both the code and database, providing you total control and management over your insurance agency's CRM system. - Finally…

Dedicated Professional Support

You will benefit from the support of an experienced team of web developers, offering specialized assistance and personalized advice tailored to your insurance agency CRM needs.

Trusted by the world's finest brands for their Custom CRM needs

Flatlogic products and services are used all over the

world, including the following notable companies:

Explore our suite of Enterprise Business Software now!

Develop world-class business management platforms with Flatlogic. We specialize in content management systems, CRM systems, ERP software and more. With our fast delivery, you get your full-stack enterprise web applications in no time.

Book a call to discover how you can generate a simple Enterprise CRM in minutes using Flatlogic's solution.

Our Clients Talk About Us

Leading companies trust us to design, develop and deploy their applications and to deliver them on time.

Contact UsLee Decker

Founder, Hubsoft

They delivered a high-quality platform and the feedback has been overwhelmingly positive. Experienced and knowledgeable, Flatlogic exceeded expectations, while their ability to work collaboratively and keep the project on track made them a reliable partner.

Ahmed Saimoon

President, Software & Services Company

After collaborating on a new site-building methodology, Flatlogic has expanded their role to other projects. They apply the new method to new situations, which demonstrates a clear understanding of the project. A flexible team, they’re able to scale up and down and even swap out members seamlessly.

David Tran

CEO, Optelos

The team delivers excellent results, providing high-quality AI and UI deliverables and ensuring that the company can respond quickly and effectively to all client requests. They are communicative and professional, handling the expanding scope well and adhering to all processes and requirements.

Cofounder, Reservation Platform

The internal team was impressed with the quality of work and the speed. Flatlogic went above and beyond to meet all needs, while their can-do attitude, exceptional communication skills, and professionalism made them a reliable partner.

Founder, QodesyQ Technologies

I only have positive things to say about the quality of their code. Unlike many other firms, Flatlogic does high-quality work at a great price. They take general concepts and turn them into functional solutions, accomplishing project goals. The team is communicative and responsive, making them a reliable partner.

Lee Mora

Director of Engineering, Software Solution Company

Flatlogic’s work has met expectations. The team’s work was clean and aesthetically pleasing, and the user interface is very intuitive. Customers can expect an efficient team that gets the job done properly.