TL;DR

- Trusted client delayed payments; continuing work led to $120K+ unpaid invoices in 2.5 months.

- Arbitration favored Flatlogic in ~3 months, but payment still stalled.

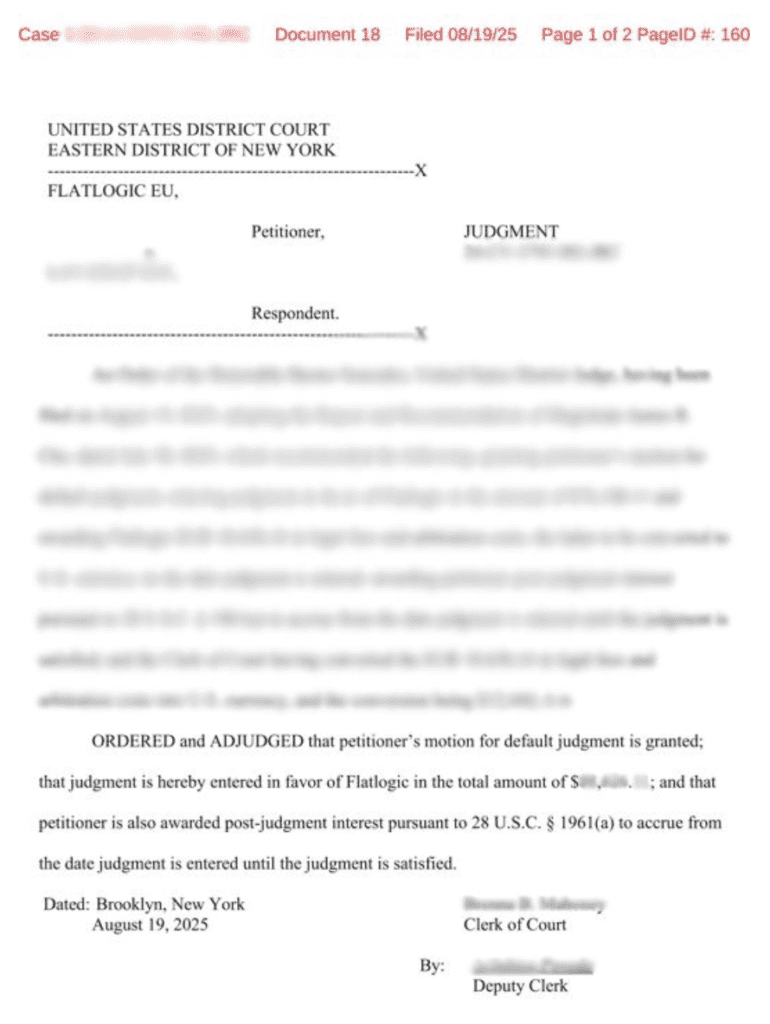

- Federal court confirmed the award on Aug 19, 2025, after a year-long enforcement fight.

- Flatlogic added stop-work triggers and stricter risk controls to prevent repeats.

Fact Box

- Unpaid invoices grew to over $120,000 after 2.5 months; Flatlogic halted work in mid-2023.

- Arbitration took about three months and ruled in Flatlogic's favor.

- Despite the arbitration win, the client did not pay.

- On Aug 19, 2025, a New York federal court confirmed the arbitration award to Flatlogic.

- The court entered judgment for the full sum owed plus additional legal costs and interest.

At Flatlogic, we’re known for building reliable, scalable, and robust software solutions. Our commitment to excellence and our clients has always guided us, but what happens when trust and goodwill alone aren’t enough? In this candid account, we share an important chapter from our journey that cost us over $120,000 due to client nonpayment. By sharing our experience transparently, other entrepreneurs and business leaders can learn from our mistakes and avoid similar pitfalls.

Background

Several years ago, our company, Flatlogic, faced one of the toughest challenges we’ve ever encountered: a significant financial hit from a trusted client. We had a strong, multi-year working relationship. Our founder, Philip Daineka, had personally met with the client several times, our teams had a strong rapport, and we had successfully delivered multiple projects together. Trust was high, and collaboration had always been smooth.

The First Warning: Delayed Payments

Trouble began in early 2023 when the expected monthly payment from this client didn’t arrive. When our founder reached out, he was reassured that the delay was temporary, a minor internal issue. Trusting our established relationship, we continued working and delivering on our commitments.

Accumulating Debt: Ignoring Early Signs

However, weeks passed and payments remained outstanding. Each inquiry our founder made was met with further reassurances and promises. Because of this trust and optimism, we continued to deliver work, convinced that the issue would resolve itself soon. By the time we finally stopped work in mid-2023, two and a half months later, the unpaid invoices had ballooned to over $120,000.

This was money Flatlogic urgently needed to cover team salaries and vendor payments, putting significant financial strain on our company and nearly pushing us into severe financial difficulties.

Legal Action: Arbitration and Court Proceedings

With no other options available, we initiated arbitration proceedings as per our contract terms. The arbitration took approximately three months, concluding in our favor. However, the client still did not pay.

We then enforced the arbitration decision in the United States federal court. This legal battle took more than a year, involving extensive documentation, hearings, and bureaucratic delays. Finally, on August 19, 2025, a federal court in New York confirmed the arbitration award, entering a judgment in Flatlogic’s favor for the entire sum owed plus additional legal costs and interest.

Hard Realities: The True Cost

Despite winning the judgment, the reality remains challenging. The client faced severe financial instability and was likely heading towards bankruptcy, making actual recovery uncertain and difficult. The prolonged legal process was not only financially draining but emotionally taxing as well.

Key Lessons Learned

From this experience, we gained several crucial insights:

- Trust Cannot Replace Risk Management: Good relationships are important, but clear, immediate actions are critical when payments stop.

- Act Decisively at Early Signs of Trouble: Had we paused the project immediately after the first missed payment, the accumulated debt would have been significantly less.

- Enforce Contractual Terms Without Hesitation: Strong contractual terms mean nothing if you hesitate to enforce them. Protect your company and team promptly.

Changes Implemented at Flatlogic

As a direct result, we implemented stronger financial controls, including:

- Clear stop-work protocols triggered by delayed payments.

- Proactive financial risk monitoring and stricter client onboarding.

- Enhanced project oversight to quickly identify and escalate any financial concerns.

Conclusion: Key Advice for Startups

If there’s one critical lesson to take from our experience, it’s this: While trust is crucial, it cannot replace vigilant, proactive risk management. As an entrepreneur, your ultimate responsibility is to safeguard your team and company. Always respond decisively at the earliest signs of financial trouble, enforce your contractual agreements without delay, and remain disciplined about your financial practices. The hard lessons we learned made Flatlogic stronger and wiser, and we hope sharing our story helps other startups avoid similar costly experiences.

Thank you for your continued support. If you have any questions or insights to share, we’d love to hear from you. – The Flatlogic Team